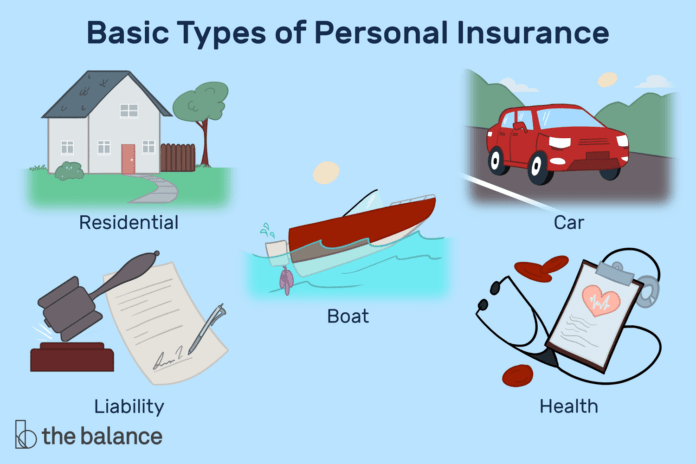

In today’s fast-paced and unpredictable world, insurance plays a crucial role in providing financial protection and peace of mind. Understanding the different types of insurance policies available is essential for making informed decisions about managing risk and safeguarding your assets. In this comprehensive guide, we will delve into the various categories of insurance, shedding light on their features, benefits, and considerations to help you navigate the complex landscape of insurance offerings.

Life Insurance:

Life insurance is designed to provide financial protection for your loved ones in the event of your death. There are several subcategories within life insurance, including term life, whole life, and universal life insurance. Term life insurance offers coverage for a specified period, while whole life insurance provides lifelong protection with a cash value component. Universal life insurance offers flexibility in premium payments and death benefits, making it a versatile option for many individuals.

Health Insurance:

Health insurance is intended to cover medical expenses incurred due to illness, injury, or preventive care. This type of insurance can vary widely in terms of coverage, cost, and provider networks. Understanding the nuances of health insurance plans, such as HMOs, PPOs, and high-deductible health plans, is essential for selecting a policy that aligns with your healthcare needs and budgetary considerations.

Auto Insurance:

Auto insurance is mandatory in many jurisdictions and is designed to provide financial protection in the event of vehicle-related accidents, theft, or damage. Liability coverage, collision coverage, and comprehensive coverage are common components of auto insurance policies, each serving distinct purposes in mitigating financial risks associated with owning and operating a vehicle.

Homeowner’s Insurance:

Homeowner’s insurance offers protection for your home and personal belongings against perils such as fire, theft, and natural disasters. It also provides liability coverage in the event that someone is injured on your property. Understanding the coverage limits, deductibles, and additional endorsements available for homeowner’s insurance is critical for ensuring comprehensive protection for your most valuable asset.

Disability Insurance:

Disability insurance provides income replacement in the event that you are unable to work due to a disabling injury or illness. Short-term and long-term disability insurance policies offer varying durations of coverage and benefit structures, helping to mitigate the financial impact of an unexpected disability on your ability to meet living expenses and financial obligations.

Understanding Insurance Policy Considerations:

When evaluating different types of insurance policies, there are several key considerations to keep in mind. These include the cost of premiums, coverage limits, deductibles, co-pays, provider networks, exclusions, and policy riders. Additionally, understanding the financial stability and reputation of insurance companies is crucial for ensuring that your coverage will be reliable in times of need.

In conclusion, navigating the world of insurance policies requires a fundamental understanding of the various types of coverage available, as well as the factors that influence policy selection. By familiarizing yourself with the basics of life insurance, health insurance, auto insurance, homeowner’s insurance, and disability insurance, you can make informed decisions that align with your risk management and financial protection goals. Remember to consult with insurance professionals to gain personalized insights and recommendations tailored to your unique circumstances and needs. With the right insurance coverage in place, you can gain confidence in facing life’s uncertainties, knowing that you have a safety net to rely on when the unexpected occurs.